- Retail invoice software free download serial number#

- Retail invoice software free download code#

- Retail invoice software free download series#

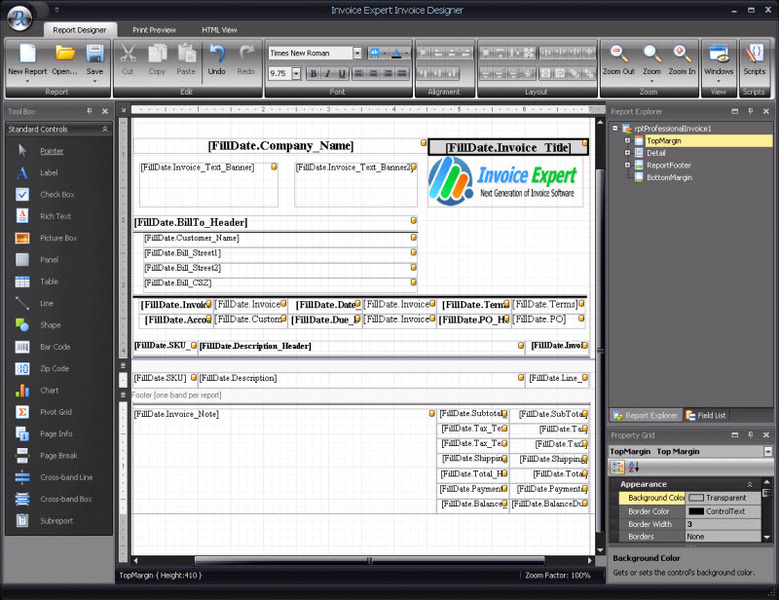

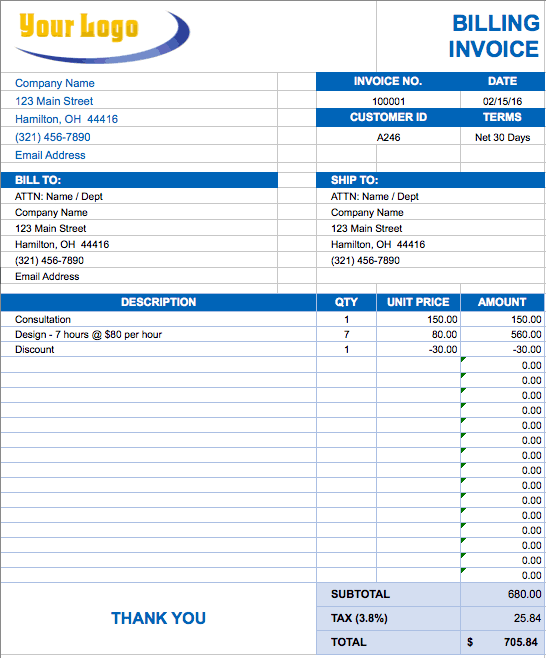

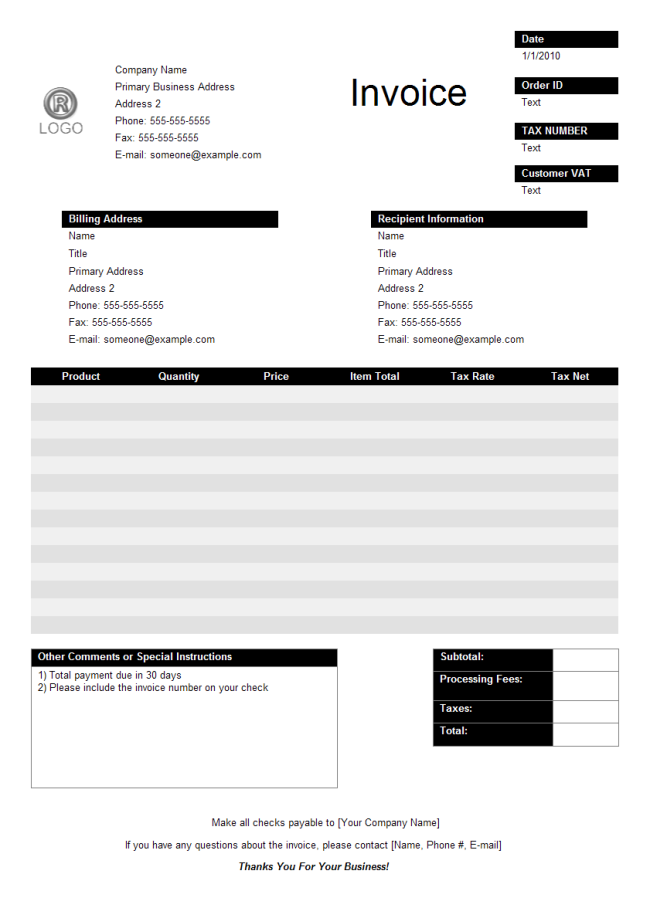

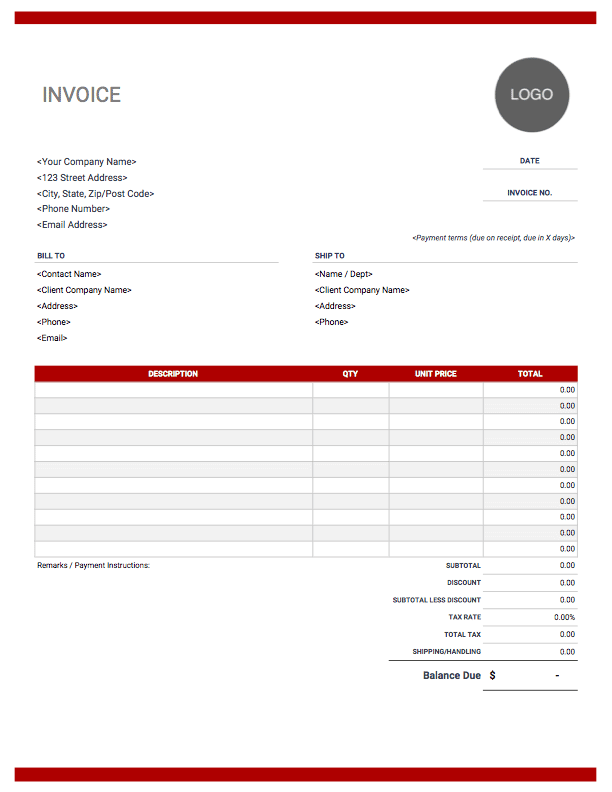

The values provided in the custom field will be stored with invoice. The fields defined in Settings, will be displayed for input in Invoice. You can add new custom fields to your invoice by defining in Settings > Sales > Custom fields. You can also add attachments related to the transaction Selected a Bank account, to be printed/showed in Invoice / Retail Invoice (also in print).(optional) These contents will be displayed in print option also. You can add more when you create estimate.

To include these charges, enable this in Settings > Sales > Sales Charges, for input in Invoice/Retail Invoice.īased on Settings > General > Sales Settings > Round off final total amount, Round Off will be calculated.Ĭontent that you provide in Settings > Sales > Notes/Terms & Conditions will be shown here. The Rate will be adjusted automatically based on the input amount. Tax will be calculated for this amount.įor Inclusive Tax: Editable, where you can define the final amount inclusive of tax. You can provide discount for Individual Item either providing as percentage or flat amountįor Exclusive Tax: Display only Taxable Value. If you have Rate Sheet defined for the Customer (or tag)/Currency of the transaction, option to choose with Standard rate. Standard Rate defined in Item Master will be displayed.

Retail invoice software free download code#

Stock Keeping Unit-Identification code for the item You can add item description, by clicking the toggle icon associated near Item column. You can also add new item if not exists in Items Master. Select the Item from the drop down or type in the Item name or SKU Code. You can edit and change the customer address while invoicing.Ĭustomer – Shipping Address for this transaction will be auto-filled, if you already saved the customer details. You can edit and change the customer shipping address while invoicing.

It will be auto-filled, if you already saved the customer details or you can enter freshly. For Intra State both SGST & CGST Tax applied, whereas IGST applied for Inter-state.Ĭustomer – Billing Address for this transaction. Based on this, the invoice will be counted as intra-state (supply within same state) or inter-state (supply to other state). For new customer, you can provide directly.Ĭhoose State to define Place of supply of goods. įor existing customers, it will be displayed on choosing their name. By clicking on that option, you can add new customer easily. On typing New Customer in invoice, you will get option to add. You can either select the Customer from the drop down or add new Customer here.

Quote / Sales Order NumberĮxport/SEZ with Payment – Payment of Tax & then collect Refund.Įxport/SEZ without Tax – Without Payment of Tax by providing bond/LUT.ĭeemed Exports – Export Invoice but goods will not leave the country. Your Reference number for this transaction. You can select from predefined period or custom period. You can change the date using calendar option associated with it. Invoice/Retail invoice number should/will be unique for a financial year.Įnter the date on which invoice/retail invoice is generated. Invoice no / Retail Invoice no will be either generated automatically or can be entered manually based on the option you choose in Settings > Modules. Click on the drop down under New Invoice button and click New Retail Invoice. Provide the needed details and Click Save. To create a new invoice, you can use the Quick Start (+ icon) or short cut (Alt+i) or New Invoice button at the top-right corner in Invoice listing page. Provide the needed fields and hit Save or Save & new button.Ĭlick Quick Add button at top & select Retail Invoice (or) Alt +N (or) Click on Sales in left menu and select Invoices. You will also have the filter option to search invoices based on the name, status & date range. You can rearrange the invoice list based on all these column headers. On clicking each will list the respective invoices.Īll your invoices will be listed with its Date, Invoice No, Contact, Due Date, Status, Amount, Due Amount. Retail Invoice is an commercial document requesting for immediate payment from retailer on purchase.Īll Invoices will be listed in Sales > Invoice. You can filter and view the list of Outstanding, Overdue and Draft Invoices with it total amount that was invoiced. Invoice is an commercial document given at the time of sales of your product that indicates that your product is sold & your customer has to pay back the money for it.

Retail invoice software free download series#

Retail invoice software free download serial number#

Serial Number Configuration in Invoice/Retail Invoice.Classifications of Invoice based on GST.

0 kommentar(er)

0 kommentar(er)